SIP Inflows Surge to Record Highs

A Reflection of Investor Confidence

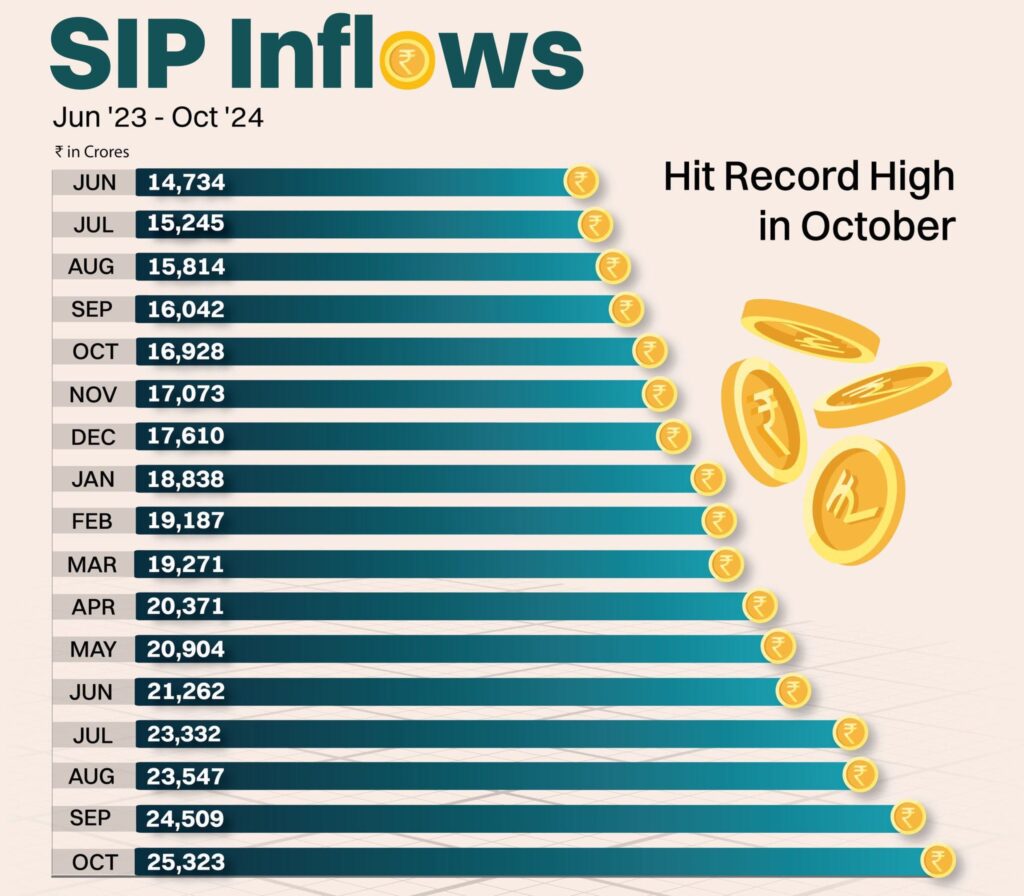

Systematic Investment Plans (SIPs) have emerged as a popular mode of investment among Indian investors, and the numbers for the past 16 months, from June 2023 to October 2024, underline this growing trend. According to data from the Association of Mutual Funds in India (AMFI), SIP inflows hit a record high of ₹25,323 crores in October 2024, marking a significant milestone for the mutual fund industry.

The Growth Journey: Month-on-Month Surge

The journey of SIP inflows over the last year and a half paints an impressive picture of consistent growth:

- June 2023 witnessed inflows of ₹14,734 crores.

- By April 2024, this figure crossed the ₹20,000 crore mark, reaching ₹20,371 crores.

- A remarkable acceleration was observed in the subsequent months, with inflows exceeding ₹23,000 crores in July 2024 and peaking at ₹25,323 crores in October 2024.

This steady climb highlights the increasing trust of retail investors in SIPs as a wealth-building tool, supported by their disciplined and consistent nature.

What’s Driving This Growth?

Several factors contribute to the surging popularity of SIPs:

- Growing Awareness: Financial literacy campaigns have encouraged individuals to understand the benefits of long-term, disciplined investing.

- Market Resilience: Despite global uncertainties, Indian equity markets have showcased strength, attracting more retail participation.

- Convenience and Accessibility: With digital platforms simplifying the SIP process, investors can easily start, modify, or pause their contributions.

- Diversification: SIPs offer exposure to a range of equity and debt funds, enabling investors to diversify risk effectively.

October 2024: A Record Month

October’s record-breaking ₹25,323 crores inflow represents more than a 70% growth compared to June 2023, reflecting both the confidence of existing investors and the onboarding of new participants. This milestone also underscores the significance of mutual funds in retail investors’ portfolios as they aim for long-term financial goals.

The Road Ahead

With SIPs becoming the backbone of mutual fund investments in India, the future looks promising. As investor awareness and market participation continue to grow, SIP inflows are expected to remain on an upward trajectory.

| Month | Year | SIP Inflows (₹ Crores) |

|---|---|---|

| June | 2023 | 14,734 |

| July | 2023 | 15,245 |

| August | 2023 | 15,814 |

| September | 2023 | 16,042 |

| October | 2023 | 16,928 |

| November | 2023 | 17,073 |

| December | 2023 | 17,610 |

| January | 2024 | 18,838 |

| February | 2024 | 19,187 |

| March | 2024 | 19,271 |

| April | 2024 | 20,371 |

| May | 2024 | 20,904 |

| June | 2024 | 21,262 |

| July | 2024 | 23,332 |

| August | 2024 | 23,547 |

| September | 2024 | 24,509 |

| October | 2024 | 25,323 |

This layout makes it easy to analyze the data and observe the growth trend.

Conclusion

The record SIP inflows in October 2024 are a testament to the resilience and trust of Indian investors in systematic investing. As more individuals embrace this financial discipline, the mutual fund industry is poised to play an even larger role in wealth creation and financial inclusion in the years to come.